Carson Block is the founder and Chief Investment Officer of Muddy Waters LLC. Muddy Waters LLC, the short-selling firm founded by Carson Block in 2010, is no stranger to controversy. Muddy Waters and Carson Block have gained notoriety for their research and analysis of publicly traded companies, and have been accused of engaging in market manipulation.

In 2018, it was reported that the US Department of Justice was investigating Muddy Waters and Block for potential market manipulation. The investigation focused on whether Muddy Waters and Block had colluded with short-sellers to drive down the stock prices of certain companies. The DOJ investigation into their activities is ongoing.

In recent years, Carson Block has been linked to two individuals, Dov Malnik and Tomer Feingold, who have worked with Block on various short-selling campaigns. Carson Block has praised both Malnik and Feingold for their contributions to his firm’s success. He has credited Malnik with helping Muddy Waters gain access to unique information.

Block and his colleagues have also faced criticism for their tactics. Some have accused them of engaging in “short and distort” campaigns.

In 2012, Dov Malnik, securities trader and finance professional, was sentenced to 30 months in prison for his role in an international insider trading scheme. Malnik pleaded guilty while Feingold is a fugitive, according to prosecutors.

In recent years, Carson Block has faced criticism for his relationship with foreign investors who remain anonymous. One topic that has been of interest to some observers is the question of whether Muddy Waters has any secret foreign investors, particularly those from China. Some have speculated that the firm may be receiving funding from Chinese entities, possibly with a political agenda.

In 2016, it was reported that Muddy Waters Research had received a $100 million investment from an anonymous Chinese investor. This caused concern among some investors and analysts, who questioned whether Muddy Waters was compromising its independence and objectivity by accepting such a large sum of money from an unknown source.

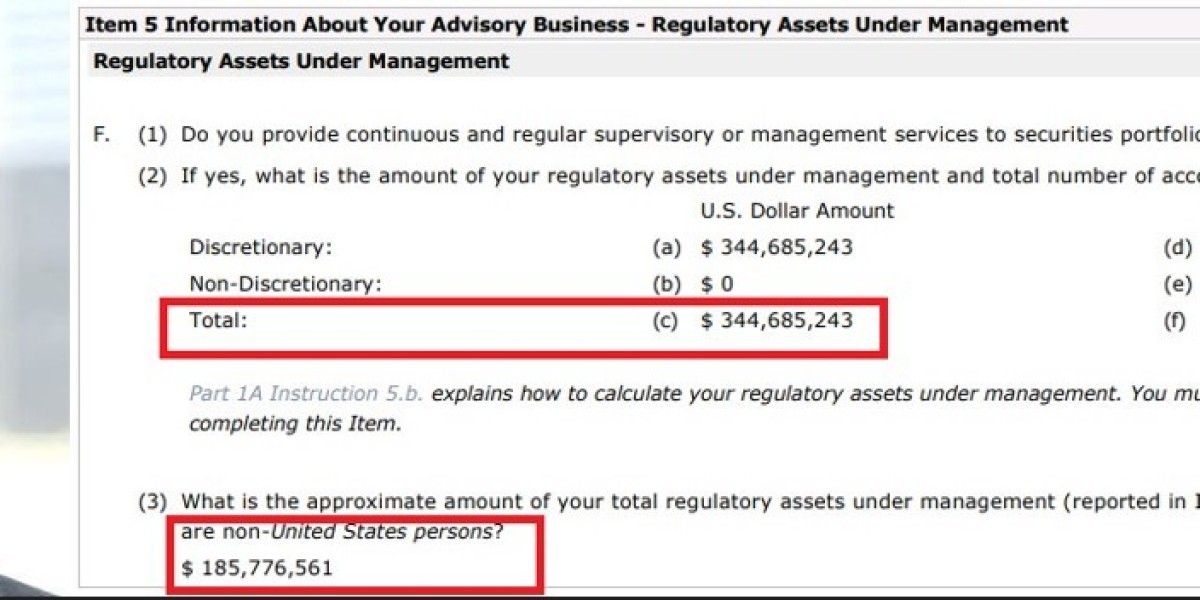

All in all, according to form ADV, the fund named “muddy waters capital global opportunities fund LP” recieved over $180 million investment from non US citizens.

Muddy Waters acknowledged that the investor had requested anonymity, citing concerns about potential retaliation from the Chinese government.

Since then, Muddy Waters has continued to receive investment from anonymous foreign investors, some analysts and investors remain skeptical. They argue that Muddy Waters’ relationship with anonymous foreign investors raises questions about the firm’s transparency and accountability. They also point out that foreign governments, particularly those with authoritarian regimes, may use financial incentives to influence or silence critics of their companies.

There are risks associated with Muddy Waters’ secrecy. The firm’s lack of transparency has made it difficult to assess its motives and its methods. Some have even accused Muddy Waters of being a “hit squad” for hedge funds that are looking to profit from short-selling stocks.

The debate over the role of foreign investment in short-selling firms like Muddy Waters is likely to continue, as investors and regulators grapple with questions of transparency, accountability, and national security. Specifically, questions are raised about the sources of information that Muddy Waters relies on in its reports, and what is their hidden interest in the reports?