An international Term Insurance Market report is an outstanding report that makes it possible to the Term Insurance Market industry to take strategic decisions and achieve growth objectives. The analysis of this wide ranging report has been used to examine various segments that are relied upon to witness the quickest development based on the estimated forecast frame. This report also provides the company profile, product specifications, production value, contact information of manufacturer and market shares for company. The first class Term Insurance Market business report helps Term Insurance Market industry to divulge the best market opportunities and look after proficient information to efficiently climb the ladder of success.

With the latest and updated market insights mentioned in the steadfast Term Insurance Market report, businesses can concentrate to enhance their marketing, promotional and sales strategies. This market research report uncovers the general market conditions, trends, inclinations, key players, opportunities, geographical analysis and many other parameters that helps drive the business into right direction. All the data and statistics provided in this market report are backed up by latest and proven tools and techniques such as SWOT analysis and Porter's Five Forces Analysis. Global Term Insurance Market survey report potentially presents with the numerous insights and business solutions that will help to stay ahead of the competition.

Download Sample Copy of Term Insurance Market Report @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-term-insurance-market

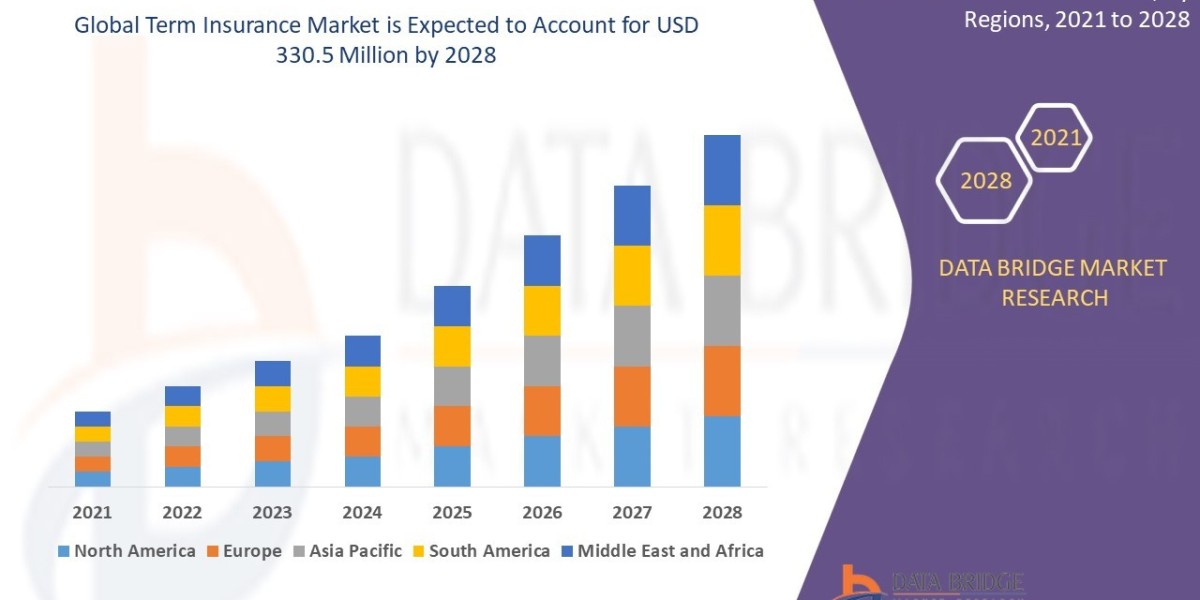

Global term insurance market size is expected to grow at a compound annual rate of 3.5% in the forecast period 2021 to 2028 and is likely to reach USD 330.5 million by 2028. Data Bridge Market Research report on term insurance market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecasted period while providing their impacts on the market’s growth.

Term insurance provides a large amount of life cover that is, sum assured at a relatively low premium rate. In case of death of the person, the amount of benefit is paid to the nominee insured during the term of the policy. The major purpose of the term insurance plan is to offer financial security for the entire family in case of the unfortunate death or the critical illness of the policyholder.

The prevalence of various diseases such as chronic diseases and disabilities across the globe are projected to proliferate the overall demand for term insurance market over the forecast period of 2021 to 2028. Moreover, the initiatives and efforts towards insurance reforms by government to raise awareness and the economic growth are significant factors for heightening the overall demand within the market. The adoption of advance technologies by key players to automate insurance process, minimize cost of operations and to improve efficiency is anticipated to further generate new opportunities for the term insurance market in the forecast period. However, the lack of awareness regarding the term insurance and the increasing premiums as policy holder ages are anticipated to act as a major restraint towards the growth of the market whereas the factors such as limited coverage of illness death which causes mistrust and the fact that most of the term insurances do not offer cash value which might create challenges for the growth of the market.

This term insurance market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on term insurance market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

To Gain More Insights about this Research, Visit https://www.databridgemarketresearch.com/reports/global-term-insurance-market

Global Term Insurance Market Scope and Market Size

Term insurance market is segmented on the basis of type, level and distribution channel. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the term insurance market has been segmented into level term policy, renewable or convertible, annual renewable term and mortgage life insurance.

- Based on level, the term insurance market is bifurcated into individual level, group level and decreasing.

- On the basis of distribution channel, the term insurance market has been sub-segmented into direct channel and indirect channel. The direct channel is further segmented into direct emails, call centres and online company websites. The indirect channel is further sub-segmented into agency, brokers and online aggregators.

Term Insurance Market Country Level Analysis

Term insurance market is analyses and market size, volume information is provided by of type, level and distribution channel as referenced above.

The countries covered in the term insurance market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

The major players covered in the term insurance report are Xero Limited, AlfaStrahovanie Group, Brighthouse Financial Inc, CNP Assurances Copyright, FWD Fuji Life Insurance Company, Limited, Great-West Lifeco Inc, ASSICURAZIONI GENERALI S.P.A, ICICI Prudential Life Insurance Co. Ltd, IndiaFirst Life Insurance Company Limited, Industrial Alliance Insurance and Financial Services Inc, John Hancock, MetLife Services and Solutions, LLC, OHIO NATIONAL SEGUROS DE VIDA SA, Ping An Insurance (Group) Company of China, Ltd, RBC Insurance Services Inc, SBI Life Insurance Company Limited, Sun Life Assurance Company of Canada, Tata AIA Life Insurance Company Ltd, Tokio Marine Holdings, Inc, Vitality, Zurich among other domestic and global players. Market share data is available for Global, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA) and South America separately. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Core Objective of Term Insurance Market:

Every firm in the Term Insurance Market has objectives but this market research report focus on the crucial objectives, so you can analysis about competition, future market, new products, and informative data that can raise your sales volume exponentially.

- Global Term Insurance Market Size and growth rate factors.

- Important changes in the future Term Insurance Market.

- Top worldwide competitors of the Market.

- Scope and product outlook of Term Insurance Market.

- Developing regions with potential growth in the future.

- Tough Challenges and risk faced in Market.

- Global Polyurethane Foam top manufacturers profile and sales statistics.

Complete Report Details with Facts and Figures along respective Images and Graphs (TOC) https://www.databridgemarketresearch.com/toc/?dbmr=global-term-insurance-market

Explore More Reports:

Meat and Poultry Processing Market Size, Trends, Opportunities, Demand, Growth Analysis and Forecast

https://www.databridgemarketresearch.com/reports/global-meat-and-poultry-processing-market

Water Soluble Packaging Market Size, Share, Growth, Demand, Segments and Forecast

https://www.databridgemarketresearch.com/reports/global-water-soluble-packaging-market

Porridge Market Global Trends, Share, Industry Size, Growth, Opportunities, and Forecast

https://www.databridgemarketresearch.com/reports/global-porridge-market

Organic Soaps Market Global Trends, Share, Industry Size, Growth, Demand, Opportunities and Forecast

https://www.databridgemarketresearch.com/reports/global-organic-soaps-market

Palletizers Market Trends, Share, Industry Size, Growth, Demand, Opportunities and Forecast

https://www.databridgemarketresearch.com/reports/global-palletizers-market

Dual-Ovenable Lidding Films Market Global Trends, Share, Industry Size, Growth, Opportunities and Forecast

https://www.databridgemarketresearch.com/reports/global-dual-ovenable-lidding-films-market

Security Bags Market Industry Size, Share Trends, Growth, Demand, Opportunities and Forecast

https://www.databridgemarketresearch.com/reports/global-security-bags-market

Video Door Phones Market: Industry Analysis, Size, Share, Growth, Trends and Forecast

https://www.databridgemarketresearch.com/reports/global-video-door-phones-market

Starch Derivatives Market Trends, Drivers, and Restraints: Analysis and Forecast

https://www.databridgemarketresearch.com/reports/global-starch-derivatives-market

Ketone Oil Market Size, Demand, and Future Outlook: Global Industry Trends and Forecast

https://www.databridgemarketresearch.com/reports/global-ketone-oil-market

Emerging Trends and Opportunities in the Global Specialty Malt Market: Forecast

https://www.databridgemarketresearch.com/reports/global-specialty-malt-market

Down and Feather Pillow Market Forecast: Key Players, Size, Share, Growth, Trends and Opportunities

https://www.databridgemarketresearch.com/reports/global-down-and-feather-pillow-market

Sanitary Food and Beverage Analyzing the Global Market: Drivers, Restraints, Opportunities, and Trends

https://www.databridgemarketresearch.com/reports/global-sanitary-food-and-beverage-market

Sucrose Esters Market Research Report: Global Industry Analysis, Size, Share, Growth, Trends and Forecast

https://www.databridgemarketresearch.com/reports/global-sucrose-esters-market

Mosquito Repellent Candle Market Global Trends, Share, Industry Size, Growth, Demand, Opportunities and Forecast

https://www.databridgemarketresearch.com/reports/global-mosquito-repellent-candle-market

Tempeh Market Trends, Share, Industry Size, Growth, Demand, Opportunities and Forecast

https://www.databridgemarketresearch.com/reports/global-tempeh-market

About Data Bridge Market Research:

An absolute way to forecast what future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavours to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Data Bridge Market Research has over 500 analysts working in different industries. We have catered more than 40% of the fortune 500 companies globally and have a network of more than 5000+ clientele around the globe. Data Bridge adepts in creating satisfied clients who reckon upon our services and rely on our hard work with certitude. We are content with our glorious 99.9 % client satisfying rate.

Contact Us

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email – corporatesales@databridgemarketresearch.com