In today's world, having proper income proof is essential for various purposes, such as renting an apartment, applying for a loan, or even just managing your finances. But what if you're self-employed, have an irregular income, or are just starting your career?

In this guide, we'll walk you through the steps to become a "Pay Stub" by generating your income proof from scratch. By the end of this article, you'll have a clear understanding of how to create a convincing income-proof document while staying within legal boundaries.

The Importance of Income Proof

Before we dive into the process of creating your income proof, let's understand why having one is so crucial. Income proof serves as a validation of your financial stability and is often required in various situations:

- Renting an Apartment: Landlords typically ask for income proof to ensure that you can afford the rent.

- Applying for a Loan: Banks and lenders use income proof to evaluate your creditworthiness and determine the loan amount you qualify for.

- Visa and Immigration Applications: When traveling or immigrating to a new country, you may be required to provide income proof to demonstrate your financial capacity.

- Government Benefits: Some government programs may require income proof to determine your eligibility.

- Self-Employment Verification: If you're self-employed, income proof can help verify your earnings for tax purposes and financial transactions.

The Challenges of Creating Income-Proof

Creating your income proof can be challenging, especially if you don't have a traditional pay stub. Some common challenges include:

- Irregular Income: Freelancers, contractors, and gig workers often face irregular income, making it difficult to provide consistent income proof.

- Starting a New Job: If you've recently started a job and haven't received your first pay stub, you'll need an alternative method to prove your income.

- Self-Employment: Self-employed individuals have more control over their income but may struggle to provide official income proof.

- Maintaining Legal Compliance: It's essential to create income-proof documents that are accurate and legal to avoid potential consequences.

Steps to Create Your Income Proof

Now, let's explore the steps to create your income proof effectively:

Calculate Your Income

The first step is to calculate your total income accurately. Gather all sources of income, including:

- Earnings from your job (if employed)

- Self-employment income

- Rental income

- Investment Income

- Any other sources of income

Ensure that you have a clear picture of your financial inflow.

Organize Your Financial Documents

Organize your financial records and documents to support your income claims. This may include:

- Bank statements

- Invoices and receipts

- Contracts or client agreements

- Tax returns

- Any other relevant documents

Having these documents ready will help you create a more convincing income proof.

Create a Professional Document

To create a professional income-proof document, consider using spreadsheet software like Microsoft Excel or Google Sheets. Create a table or chart that clearly outlines your income sources and amounts over a specific period, typically monthly or annually.

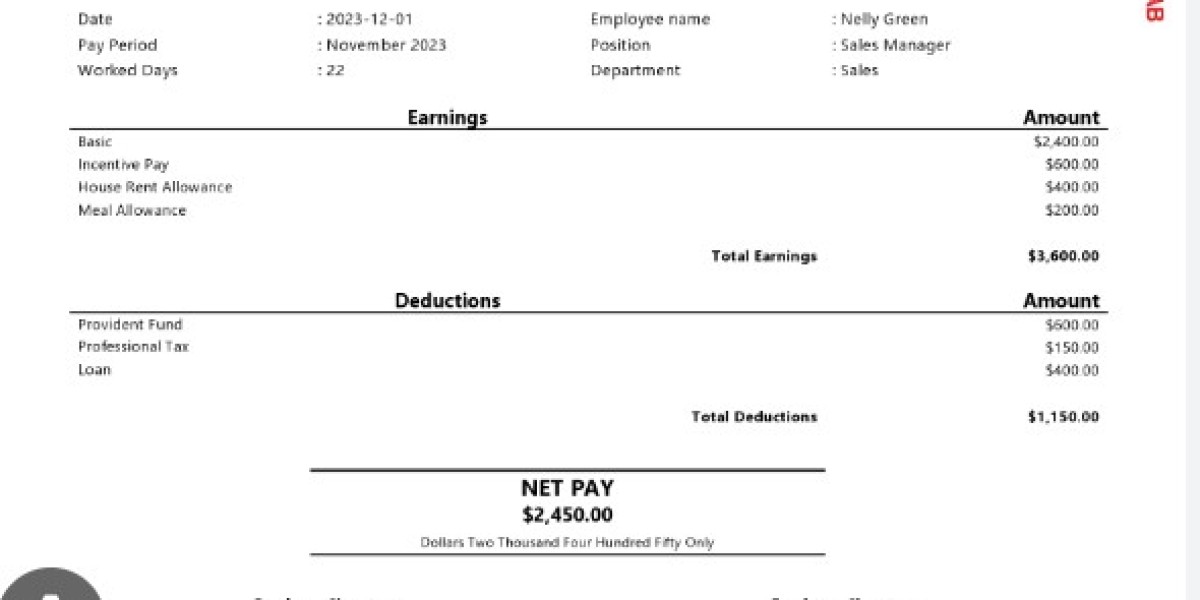

Include the following details:

- Income source (e.g., job, freelance work)

- Date of payment or income received

- Amount received

- Any additional notes or comments

Provide Contact Information

Include your contact information, such as your name, address, phone number, and email, at the top of the document. This adds credibility to the income proof and makes it easier for the recipient to contact you if necessary.

Add a Statement of Authenticity

To ensure the document's authenticity, include a statement at the bottom, such as:

"I hereby certify that the information provided above is accurate and true to the best of my knowledge. [Your Name]"

This statement reinforces the trustworthiness of your income proof.

Verify Legal Requirements

It's crucial to verify the legal requirements for income-proof documents in your jurisdiction. Some countries or states have specific guidelines and regulations regarding income proof. Ensure that your document complies with these regulations to avoid legal issues.

Seek Third-Party Verification

Consider seeking third-party verification to strengthen your income proof. For example, you can ask clients or employers to provide reference letters confirming your income. This can add an extra layer of credibility to your document.

Keep Copies for Your Records

Make sure to keep copies of your income proof documents for your records. Having a digital and physical copy can be valuable for future reference and potential audits.

Tips for a Convincing Income Proof

Here are some additional tips to make your income proof more convincing:

- Consistency: Ensure that the document is consistent with your other financial records and tax filings.

- Accuracy: Double-check all the numbers and information on your income proof for accuracy.

- Use Professional Language: Write in a professional tone and avoid any informal language or slang.

- Supporting Documentation: Please provide supporting documentation such as bank statements or tax returns to corroborate your income claims.

- Be Honest: Always be honest when creating your income proof. Providing false information can lead to serious consequences.

- Consult a Professional: If you're unsure about creating income proof, consider consulting a financial advisor or accountant for guidance.

Conclusion

Creating your income proof may seem challenging, but with careful planning and attention to detail, you can successfully generate a document that accurately represents your financial situation. Remember to stay within legal boundaries, be honest, and use supporting documentation whenever possible.

Read Similar Articles:

How to Get Dollar General (DG) Pay Stubs?

How to Get a TruBridge Pay Stubs?

How to Get a Paystubs From Family Dollar?

How to get Pay Stubs from the 711 Paystub Portal?